Five opportunities growing within the food industry in 2024

Fast shifting consumer behaviour is driving change in the Food industry.

Though there’s a lot happening, it’s an exciting time – these changes bring about many opportunities for success and growth.

Read on to discover some of the top opportunities currently seen in the industry.

1 – Healthy Eating

Consumers are becoming more conscious of healthier eating, and there is a growing push for this by the Government, who have recently imposed new legislation restricting the promotion of foods high in fat, salt or sugar (HFSS).

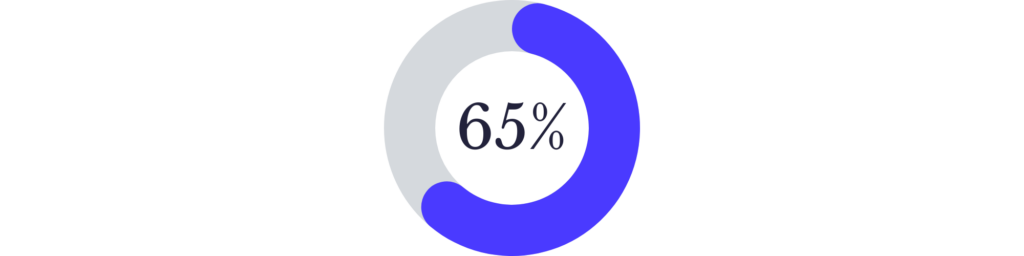

Conducting research on Vypr, we found that most consumers (65%) feel positive about these proposed changes to HFSS foods. Many want to see less fat, sugar and salt in their products, with 48% specifically wanting to see this in ready meals, and desserts close second at 42%. Most want to see HFSS reduced through reformulation of products (42%).

However, now that some products have implemented such changes, we found that consumers have concerns around changes in taste of some of these items.

This means that, generally, consumers do want to see healthier products but don’t want to sacrifice on taste.

So, what does this mean for products?

The demand for food that delivers on health without sacrificing taste and quality appears to be rising.

Additionally, 64% of consumers are currently prioritising value for money across all purchases. Therefore, if a product can offer health with value, it puts itself forward for a real chance of continued success as the interest in healthy eating continues to grow.

The specific needs within each category depend on a businesses’ own products, brand images, and targets – which can only be teased out through individual research of their target audiences.

2 – Changing Consumption Behaviours

The cost-of-living crisis is a key reason for the inflated interest in products that offer good value, and this crisis is also impacting how consumers are eating and preparing their meals.

Cooking from scratch

35% of consumers voted that they’re cooking more meals from scratch (particularly easy-to-prepare ones) as a direct result of the cost-of-living crisis. The way they’re preparing them is also changing – many mentioned using slow cookers and air fryers to prepare meals, reducing their energy consumption.

Despite this increase, the demand for ready meals is still growing.

Ready meal consumption

Many consumers currently consume ready meals – 30% of consumers say they eat them often, and only 16% of our nationally representative sample say they don’t eat them at all.

When we followed up to ask why they buy them, we found that the main reason was convenience, as they’re quick and easy to prepare when short on time.

So, despite the cost-of-living crisis, demand for purchasing these products instead of cooking from scratch still exists. In fact, some consumers said they buy these products as they can be microwaved, reducing energy usage and therefore saving them money on their bills.

So, what does this mean for products?

There is an opportunity here to help meet consumer needs through a particularly difficult economic time.

Focused investment into optimising products depending on consumer needs will be essential – for example, great-value ready meals to help those looking for convenience, or perhaps meal kits to help those looking to cook more.

Keeping pace with consumers with frequent research can help in this pursuit. However, as most people continue to seek the most value for their money, companies will need to test thoroughly to optimise the price of products for the value they provide.

3 – Demand for Varied Plant-based Products

During our research on ready meals, we discovered consumer demand for more plant-based options, especially those that use ingredients in innovative ways to create tasty dishes. This growth is evidenced by the fact that 17% more people say they’re taking part in Vegan month challenge Veganuary this year, compared to last year.

We found non-vegan/vegetarian groups (committed carnivores, omnivores, and meat reducers) are somewhat interested in trying plant-based food (33%). This is a very positive sign as it means there is a larger audience to promote products to and a real chance for this sector to keep growing. 18% are very interested, and 12% say they already buy these products.

We followed up to see what would make them more interested in trying plant-based, and found the following:

- More interesting options and flavours

- Less processed food, especially in meat alternative products

- Clearer ingredient labelling and quality sourcing

- More recipe ideas

So, what does this mean for products?

This sector is fast-growing and opportunities exist here, but companies need to be careful to develop products that will meet their specific target audience’s needs.

For example, focusing only on meat alternatives leaves out other growth areas to be explored for groups such as Vegetarians and Vegans, that may not want to eat anything that looks like meat, but try new innovations instead.

We saw some other product opportunities in the plant-based sector in responses – these included the desire for more soya-free options, along with different cheeses and pizzas. One consumer also wanted to see more egg replacements, and it’s interesting they say that as this may indeed begin to grow, fuelled by recent supply shortages – read more below.

4 – Supply Shortages Shifting Choices

Sudden shifts in the supply chain have affected a lot of decisions in 2022. As an example most recently, a shortage of eggs due to the bird flu outbreak has meant consumers have not had access to the supply they normally would.

Due to supply chain issues, it’s natural that consumers who buy these products will look for alternatives, so we’re likely to see changes to product choices, in this case mostly where egg is needed as an ingredient within a recipe, rather than on its own.

Consumers are not opposed to the idea of foods containing egg alternatives – in fact, 47% would be willing to purchase these products. When filtering results by diet, carnivores were the least likely to purchase, and meat reducers were the most likely, along with vegetarians/vegans.

Baking has been particularly affected

As eggs are required for a lot of baked goods, it’s no surprise baking has been affected. Though egg-free baking is already popular with many, the above shortages mean this demand is also expanding as more people are forced to look for alternative recipes and ideas.

So, what does this mean for products?

Keeping up to date with changing situations and how they’re affecting consumer behaviours can unlock many opportunities for success. With supply issues potentially lasting and shifting behaviour further, it’s worth exploring more due to increased potential for demand.

Companies have already developed interesting products to jump on this opportunity. For example, ‘Aquafaba’ is an egg substitute made from chickpeas which forms a foam much like egg whites. As the process to make it from scratch is time-consuming, products that offer this ready-to-use with well-tested messaging stand to gain a positive image with consumers, which can already be seen on shelves.

This is just one example of supply shortages, and how they can shift behaviour quickly. Keeping pace with the consumer through research ensures opportunities are not missed.

5 – Shifts to Value Products

As we’ve seen earlier, it’s no surprise that consumers are prioritising value at this time of economic crisis. During such situations, consumer loyalty tends to reduce for many products, creating opportunities for new innovations within the market, specifically in the own label/value category.

Own label products are traditionally cheaper than branded ones, and so predictably at this time, 61% of consumers say that some of their shopping is made up of supermarket own brand products or those from value ranges.

Nearly a third (30%) said these products make up most of their shopping,

which shows just how large the opportunity is here for these products.

And this is not a fleeting opportunity – now consumers have tried these items, 73% say they’ll continue buying them to make up some of their shopping, and 23% will continue buying them to make up most of their shopping.

So, what does this mean for products?

For most products, barring some branded favourites, consumer loyalty switches based on changing priorities.

To keep ahold of consumers, investing in keeping prices affordable will definitely help, however it is essential to not forget innovation, as this is another factor in setting products apart from other ranges.

In conclusion, changing legislation, inflationary pressures and shifting behaviours are creating opportunities in the food industry.