In-Brief

Knowledge and transparency:

There is a knowledge gap among consumers regarding what ‘ultra-processed’ foods consist of, suggesting a need for greater transparency and education about food processing.

Innovation and engagement:

Innovation in product development that aligns with healthier lifestyles is essential. There’s also a need to engage directly with consumers to gain actionable insights for smarter product and marketing strategies.

Mixed sentiments on health impact:

The report uncovers mixed sentiments among consumers regarding ultra-processed foods, driven by health concerns on one side and a neutral stance from those less informed about their effects.

Introduction

Ultra-processed foods were a major talking point in 2023. It’s set to become an even bigger focus in 2024. But what’s the real story? Are consumers truly aware of what these foods are and the impact they may have on their health?

We asked our community of over 75,000 consumers to bring clarity to this debate. Our report investigates the level of understanding and concerns around ultra-processed foods – demystifying consumer attitudes in an ever-evolving landscape.

Prefer a PDF?

If you’d prefer to access this report in PDF format you can simply download it below.

This is crucial reading for those in the food and beverage industry. It’s time to discover whether ultra-processed foods are just a media buzzword or a genuine consumer concern.

Read on to discover some consumer insights that could reshape your product strategies.

Eating habit changes

Before diving into the topic of ultra-processed foods, let’s first understand current consumer eating habits. What are the key changes they’re making?

To find out, we asked a qualitative free text steer (what we call questions). We wanted to understand what really matters to consumers in their dietary decisions. The results show that there is a clear shift towards healthier choices:

- Embracing healthier eating habits

- Increasing fruit and vegetable intake

- Reducing red meat consumption

- Focusing on higher protein foods

Interestingly, there was no mention of ‘ultra-processed’. There were mentions of cutting down processed foods a handful of times. This could be due to rising prices in the cost of living meaning consumers are cooking more from scratch or likely to be beginning the new year with the best intentions.

What is ultra-processed food?

When it comes to ultra-processed foods, there’s a pivotal question to ponder: How well do consumers understand what these foods are? Our data paints an intriguing picture of awareness and gaps in knowledge.

50% of respondents have heard the term ‘ultra-processed foods’ yet are unable to explain what it actually means. This highlights a significant awareness yet a clear need for more information.

Do you know what ultra-processed food is?

On the other hand, nearly 30% of consumers confidently expressed their ability to explain what ultra-processed foods are. Here are some of their responses:

Food that has been processed often partially cooked usually contains additives to keep it lasting longer, such as mushy peas which contain colouring and flavouring and are cooked prior to canning.

Female aged 35-44

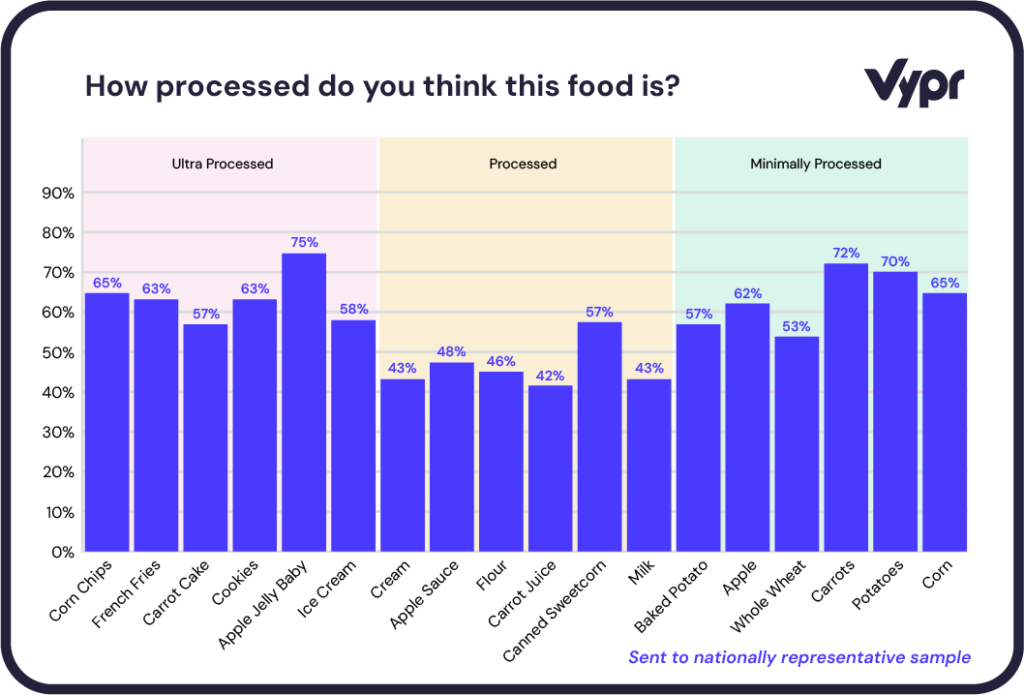

Whilst some consumers may not be able to explain what ultra-processed is, do they know what foods fall under this criteria? Using Vypr, we ran a series of Vykert steers (our version of a likert) on 18 food products to see if they understand how processed each product is.

These are foods that have additives, colourings and go through processes to preserve their shelf life.

Male aged 55-64

Lots of added ingredients preservatives flavourings water for forming and long cooking process, unhealthy but in moderation not too bad .

Female aged 65+

Here we totalled the highest percentage of each option (Minimally, Processed or Ultra) for each product.

These results indicate consumers are clear about what is minimally processed and what is ultra-processed. When it comes to processed foods (which means any food that has been altered in some way during preparation) respondents were not as confident.

This is reflected in the baked potato. 57% believed it is a minimally processed food, but once a potato is baked it has been processed.

Level of concern

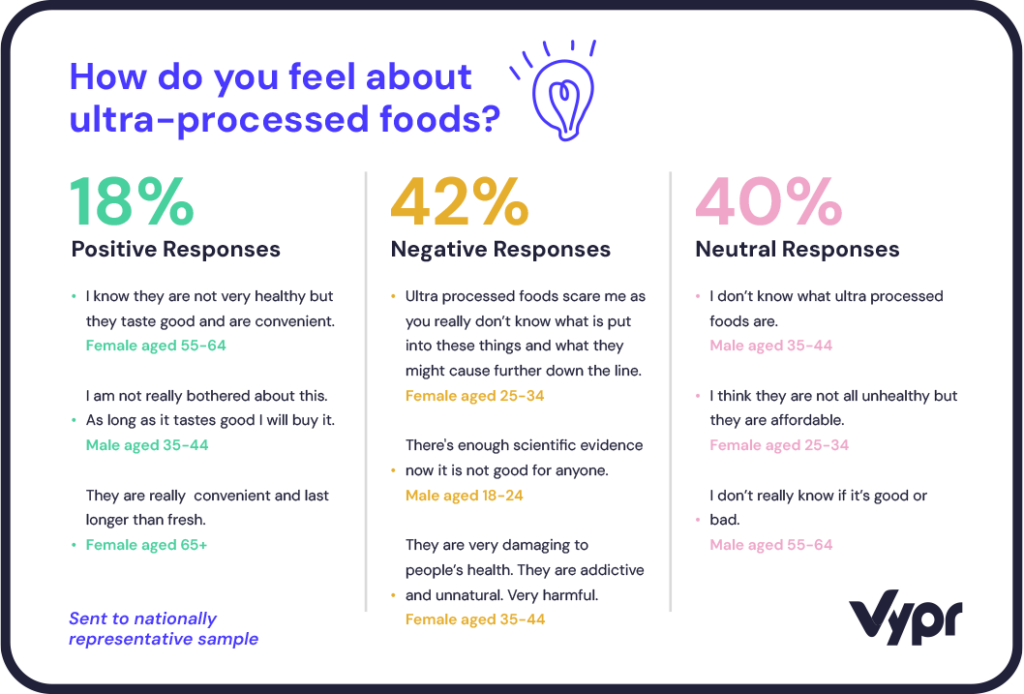

So how concerned are consumers about ultra-processed foods? To gauge consumer sentiment towards ultra-processed foods, we ran a Sentiment Steer. This gives us a clearer insight into their feelings on the matter.

The responses were quite telling: 42% expressed a negative view, while a notable 40% remained neutral. Those who indicated a neutral response often stemmed from uncertainty about what ultra-processed foods are.

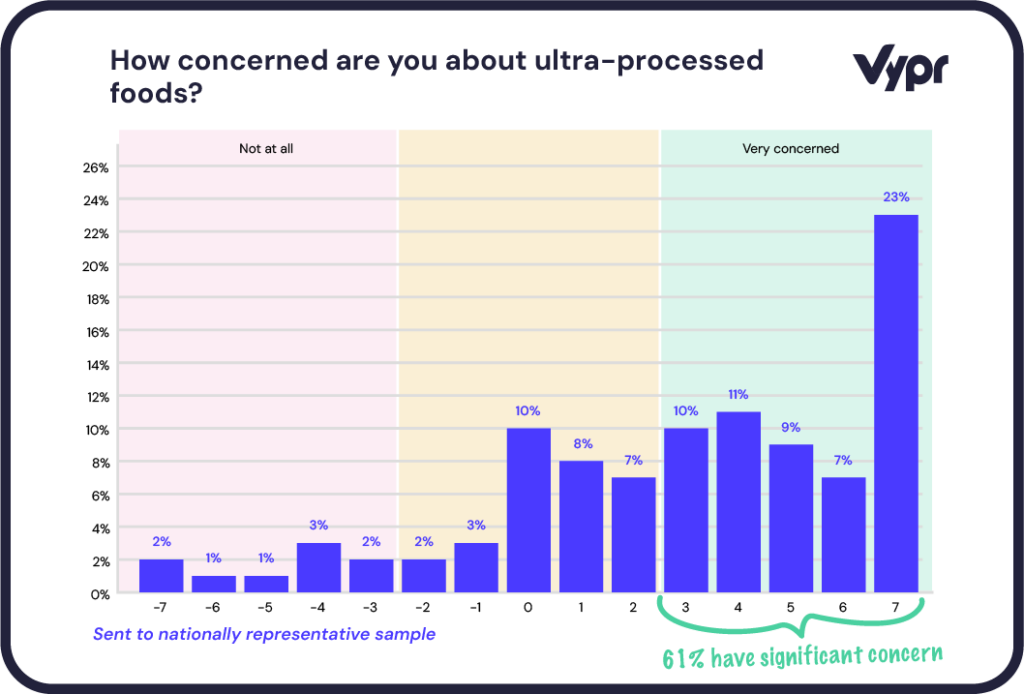

To ask consumers more directly, we then ran a Vykert Steer.

Here, 61% of respondents voiced significant concern about ultra-processed foods, highlighting that they believe it is a worry even if they don’t understand it.

With this concern in mind, we wanted to understand how consumers plan to cut down on eating ultra-processed foods

The results showed that 37% plan to cook more homemade meals and 36% aim to increase their intake of fruits, vegetables and grains. However, 25% admitted to not making any dietary changes yet. Reflecting on the unprompted responses from earlier in this report, these top two strategies mirror the initial consumer intentions.

It seems that for those already planning healthier food choices, addressing ultra-processed foods concerns aligns seamlessly with their goals – a real win-win in the journey towards healthier eating.

This not only spotlights a proactive move towards healthier, food choices but also signals a significant opportunity for brands. It’s a call to action for innovation in offering products that meet consumer demand for transparency and nutritional clarity.

Which steps have you taken to reduce your intake of ultra-processed foods?

Awareness vs understanding

In light of the ongoing cost-of-living crisis in the UK, understanding consumer concerns is more crucial than ever. Our research reveals that rising prices are the primary worry, highlighted in 51% of responses, and highlighting the significant impact on consumer behaviour.

Interestingly, the issue of ultra-processed foods emerges as the second most noted concern, with 12% of participants expressing apprehension. This indicates a growing awareness and negative perception of these foods among consumers.

However, the results weren’t close, with many more consumers choosing ‘increased prices’ as their main worry when food shopping over ‘ultra-processed foods’. It’s clear that affordability remains the main concern for most.

What worries you the most when food shopping?

Sent to nationally representative sample

Next, we wanted to understand how much of an impact labelling a product as ‘ultra-processed’ has.

To achieve this, we ran a blind A/B test using the ‘Split by Description’ steer. This steer showed consumers only one of two descriptions for a product.

We used a generic image of sliced white bread with two contrasting labels: ‘Sliced white bread’ and ‘Ultra processed sliced white bread’.

The results were clear. For the option labelled ‘Ultra-processed’, just 44% of consumers indicated they would buy the product. This was significantly less compared to the more neutrally described ‘Sliced white bread’. Currently only 30% of those questioned stated they know what ultra-processed foods are and can explain them. As this awareness grows, there is likely to be a negative impact on sales of products that are ultra-processed.

Which steps have you taken to reduce your intake of ultra-processed foods?

Conclusion

In conclusion, the shift towards healthier dietary choices and a growing preference for fresh, homemade meals is reshaping consumer attitudes towards ultra-processed foods.

This report uncovers a clear demand for greater transparency and education about food processing. The insights highlight both challenges and opportunities for the food and beverage industry, emphasising the importance of adapting marketing strategies and product offerings to meet evolving consumer needs.

- Consumer education

Address the knowledge gap about ‘ultra-processed’ and processed foods through informative, clear communication, to empower consumers with knowledge. - Ingredient transparency

Uphold transparency in ingredients and processing. For those who manufacture ultra-processed foods, to loom at how they communicate this. - Innovative product responses

Innovate with products that align with healthier lifestyles, to meet evolving market demand.

- Engagement and insight

Engage in ongoing dialogue with consumers to understand their preferences, using insights to shape future product offerings. - Adaptive marketing strategies

Develop marketing strategies that reflect an understanding of consumers, focusing on health and well-being.

Using Vypr can be instrumental in understanding these shifts, offering a platform for engaging directly with consumers to gain actionable insights. It can help drive smarter product development and marketing strategies that resonate with today’s health-conscious consumer.

Better decisions,

winning products.

Are you ready to redefine your product development strategy and secure a competitive advantage in your industry? Find out about the power of Vypr today.

Get FREE consumer research