What Do The New HFSS Regulations Mean For The Food Industry?

From the 1st of October, the government’s new regulations on high in fat, salt or sugar (HFSS) products in England come into force, banning retailers from offering volume-based promotions on these products. The regulations aim to address rising obesity rates by restricting how HFSS products are marketed and sold.

Under the new HFSS legislation, businesses with over 50 employees, regardless of the shop size, can no longer offer the following volume-based promotions:

- Buy one get one free (BOGOF) deals

- Multi-buy deals, such as ‘3 for £12’

- Party-style platters, including HFSS items

- Free refills for sugar-sweetened beverages

- Offering HFSS items in loyalty point deals

These regulatory changes will not only affect how businesses arrange their shops and structure deals, but also raise an important question: will they influence consumer behaviour?

Key Takeaways

Consumers asking for healthier products to match the price of non-healthy products increased from 41% in 2021 to 47% in 2025

The percentage of consumers who would pay more for HFSS products decreased from 61% in 2022 to 27% in 2025

24% of consumers now regularly buy healthy food compared to 17% in 2022

However, negative sentiment towards government legislation of HFSS products increased from 29% to 34%

Are Consumer Habits changing?

Back in 2021, consumers were already beginning to voice frustrations about the lack of affordable, healthy options.

41% said they wanted healthier options to match the price of non-healthy options, 33% of consumers called for more promotions on healthier food, and 25% asked for a wider range of healthy products to be launched to increase their options.

Fast forward to 2025, and these demands have only grown stronger. 47% of consumers wanted healthier products to match the price of HFSS products, 35% asked for more promotions on healthier options, and 32% wanted more healthy ranges to be launched.

These changes show that consumer expectations have shifted over the past four years. Consumers are now more likely to demand healthier options on the shelves than they were in 2021.

This shift is reinforced by how much less importance consumers now place on HFSS products.

When we asked consumers whether they would pay more for HFSS products in 2022, 61% said they would. When we asked the same question to consumers in 2025, that figure dropped to 27%.

This sharp decline suggests HFSS products are losing their premium appeal. Instead, consumers appear to be more focused on value, and increasingly, they see that value in healthier choices.

Attitudes toward everyday eating reflect the same trend. In 2022, only 17% of consumers reported regularly buying healthy food. By 2025, that figure had risen to 24%.

The increase may seem modest, but across millions of households, it marks a growing market shift towards healthier eating habits.

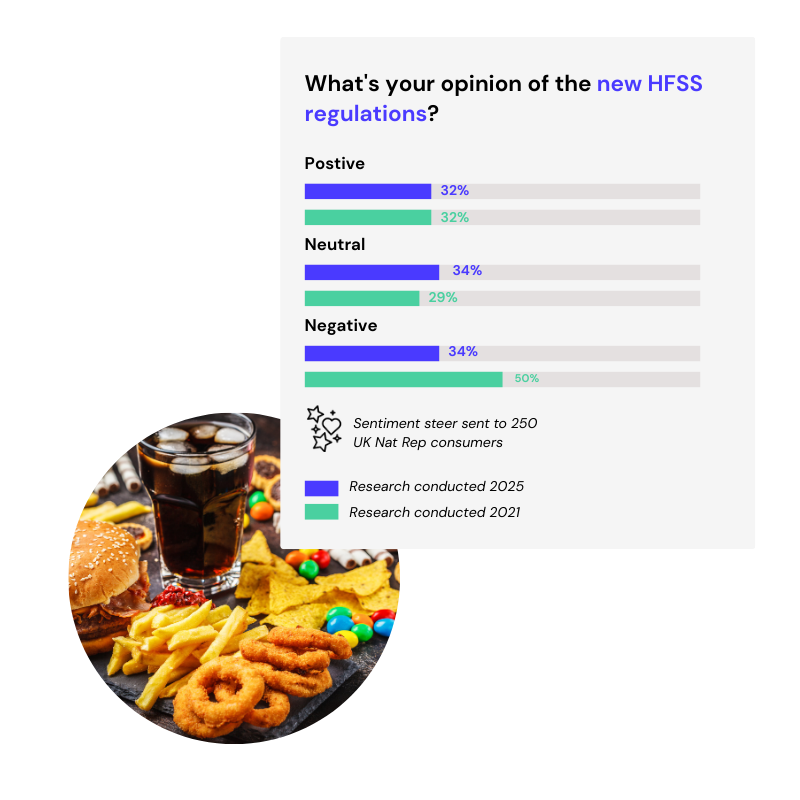

Interestingly, support for regulation has not kept pace with this behavioural change. Positive responses to HFSS legislation remained steady at 32% between 2021 and 2025, while negative responses increased from 29% to 34%.

This suggests that while consumers are becoming more health-conscious, they still prefer to make their own decisions rather than be guided by government rules.

Consumer habits are changing, with healthier eating no longer seen as a niche preference but an expectation. Price sensitivity, declining interest in HFSS products, and growing demand for healthier ranges all signal a market in transition.

For the food industry, the challenge is no longer about recognising this shift but about responding to it. Marketing strategies, pricing models, and product development will all need to evolve to keep pace with consumer sentiment. The businesses that adapt quickest will be the ones best placed to thrive in this new landscape.

With consumer sentiment and regulations changing, there’s never been a better time to look at your product offerings and how they’re positioned in an ever-changing market. Book a Demo with Vypr today to see how we can help.

How Might Promotions Change for Consumers?

With traditional “buy one get one free” and multibuy offers on HFSS products banned, consumers are set to notice some changes on the shelves. That doesn’t mean these discounts will disappear, just that they may look different.

Simple price reductions, such as 50% off or save £1, are not covered by the regulations and could be used to appeal to those customers still interested in purchasing HFSS products.

Meal deal offers aren’t included in the regulations either. Consumers could see more meal deals based around HFSS products in the future, as businesses adapt to the new regulations.

BOGOF and multi-buy deals won’t disappear; instead, they will focus on non-HFSS items. By focusing on healthier products, businesses can nudge consumers toward different choices in line with current sentiment around healthier options.

With growing consumer interest in healthier eating, “swap and save” style promotions may become more common, with lower-sugar or lower-fat versions of products highlighted as value options.

As restrictions on TV and online advertising tighten further, with a ban on paid online HFSS ads from January 2026, brands are likely to lean on their own apps, websites and social channels to reach consumers directly.

Consumers could see more deals that encourage them to save money on healthier alternatives, be it promotional offers or loyalty-based deals.

Meeting Consumers Where They’re Headed

The new HFSS regulations represent a new era for the food industry. While retailers may initially feel restricted, these changes align with evolving consumer preferences over the past four years.

With more consumers favouring healthier choices and driving the shift themselves, it presents an opportunity for brands to innovate, rethink promotions, and use valuable consumer insights to reinforce their position in a health-conscious market.

For the food industry, the challenge isn’t just compliance; it’s learning to thrive in a world where healthy eating is no longer just a government priority, but something consumers are demanding more of.

Looking to adapt to new HFSS regulations?

Find out how Vypr can help you adapt to new HFSS regulations and position your products to meet changing consumer sentiment today.